Price: $10.99 - $7.89

(as of Apr 11, 2025 20:39:03 UTC - Details)

The Best Travel Rewards Credit Card: Unlocking Your Travel Dreams

Introduction

Are you dreaming of your next getaway but feel held back by costs? Enter the world of travel rewards credit cards. They are not just plastic; they are your ticket to dream vacations, upgrades, and exclusive experiences. In this guide, we will explore the best travel rewards credit card options available today. Whether you're a frequent flyer or an occasional traveler, understanding how these cards work can help you maximize your benefits and turn your travel dreams into reality.

Understanding Travel Rewards Credit Cards

What Are Travel Rewards Credit Cards?

Travel rewards credit cards are designed to earn you points or miles for your spending. Each purchase can earn you rewards that can be redeemed for flights, hotel stays, and more. These cards often come with additional perks, such as travel insurance, no foreign transaction fees, and access to airport lounges.

How Do They Work?

When you use a travel rewards card, you earn points or miles for every dollar spent. These points can be accumulated and redeemed for travel-related expenses. Some cards also offer bonus points for specific categories, such as dining or travel purchases. The key is to choose a card that aligns with your spending habits to maximize your rewards.

Choosing the Right Card

Factors to Consider When Selecting a Travel Rewards Card

When looking for the best travel rewards credit card, consider the following:

-

Annual Fees: Some cards have no annual fees, while others may charge a hefty fee. Weigh the benefits against the costs.

-

Rewards Rate: Look for cards that offer high rewards rates on categories you frequently spend in.

-

Bonus Offers: Many cards offer sign-up bonuses. These can significantly boost your rewards when you first get the card.

-

Redemption Options: Check how you can redeem your points. Some cards offer more flexibility than others.

- Additional Benefits: Consider perks like travel insurance, no foreign transaction fees, and lounge access.

Top Travel Rewards Credit Cards

1. Chase Sapphire Preferred

Long-Tail Keyword: Chase Sapphire Preferred travel rewards card

The Chase Sapphire Preferred card is widely regarded as one of the best travel rewards cards. It offers a generous sign-up bonus and allows you to earn 2 points per dollar on travel and dining. One of its standout features is the flexibility in redeeming points, whether for travel, cash back, or gift cards.

2. Capital One Venture Rewards

Long-Tail Keyword: Capital One Venture Rewards credit card

The Capital One Venture Rewards card is perfect for those who want straightforward rewards. You earn 2 miles per dollar on every purchase, and there's no need to track categories. Plus, the miles can be used to erase travel purchases or transferred to various airline partners, maximizing your travel options.

3. American Express Gold Card

Long-Tail Keyword: American Express Gold travel rewards card

If you dine out frequently, the American Express Gold Card might be your best bet. It offers 3 points per dollar on dining and 4 points on restaurants, making it great for food lovers. Although it has a higher annual fee, the rewards can easily outweigh the costs for frequent diners.

Maximizing Your Rewards

Tips to Get the Most Out of Your Travel Rewards Card

-

Pay Your Balance in Full: To avoid interest charges, always pay your balance in full each month.

-

Use Your Card for Everyday Purchases: The more you use your card, the more rewards you earn.

-

Keep an Eye on Bonus Categories: If your card offers bonus points for specific categories, make sure to use it for those purchases.

-

Take Advantage of Sign-Up Bonuses: Meet the required spending within the first few months to earn those lucrative sign-up bonuses.

- Redeem Wisely: Research the best ways to redeem your points for maximum value, whether for flights, hotels, or other experiences.

Common Mistakes to Avoid

Travel Rewards Card Pitfalls

-

Ignoring Annual Fees: Always factor in the annual fee when considering a card. Choose one that balances rewards with fees.

-

Forgetting About Redemption Rules: Each card has different rules for how you can redeem points. Familiarize yourself with these to avoid surprises.

-

Not Using the Card Enough: To earn rewards, you need to use your card. Make it a habit to use it for regular purchases.

- Overlooking Additional Benefits: Many cards come with perks like travel insurance or rental car coverage. Make sure to leverage these benefits.

Conclusion

In a world where travel can be expensive, the best travel rewards credit card can be your best friend. By understanding how these cards work and choosing the right one for your needs, you can unlock a world of possibilities. Whether it’s earning points for flights, enjoying luxury hotel stays, or simply making your travel experience smoother, the right card can transform your journeys.

So, as you plan your next adventure, remember—your travel rewards credit card is more than just a means to pay; it’s a gateway to exploring the world. Choose wisely, spend smartly, and watch your travel dreams come to life.

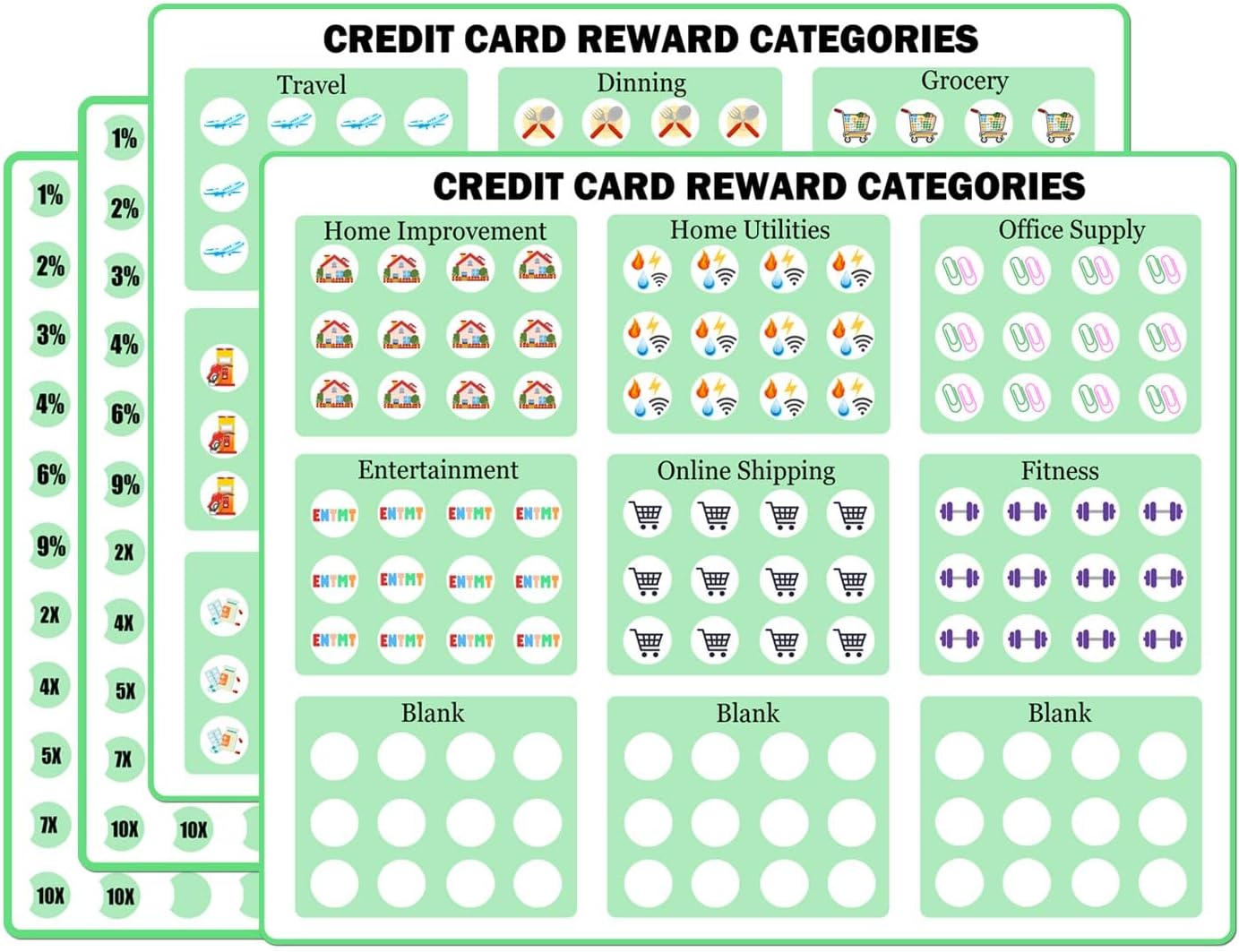

Package includes: You will receive a total of 502 Pcs credit card stickers, sufficient in quantity to meet your daily recording and replacement needs.Sharing with your friends, family, and colleagues is also a good choice

Elegant and classic design: Credit card points and mileage stickers use blue and white as the theme colors, creating an elegant and fashionable theme sticker that adds a trendy combination to your credit card

Classified Use Helper: Credit Card Reward Stickers with patterns representing various expenses, it helps you Reward credit cards with different spending purposes. The unique design of percentages, multipliers, and blanks can help you use your credit card more efficiently and with maximum discounts

High quality choice: Rewards Theme Gas Travel Dining Categories Stickers are made of high-quality vinyl materials, with clear printing and not easily fading.Their waterproof and tear resistant properties make them very durable and can provide you with long-term service

Convenient to use: These credit card classification stickers use high-quality adhesive on the back, making it easy to stick the label and not easy to peel off. Simply clean the surface of the card and you can immediately stick and use it

The Best Travel Rewards Credit Card: Your Ultimate Guide to Earning Miles and Points

Traveling can be one of the most rewarding experiences in life, but it can also be quite expensive. Fortunately, using the right travel rewards credit card can help you make the most of your spending. In this guide, we will explore the best travel rewards credit cards available right now, how they work, and how to choose the right one for your travel needs.

What Are Travel Rewards Credit Cards?

Travel rewards credit cards are specially designed to help you earn points or miles for every dollar you spend. These rewards can be redeemed for flights, hotel stays, and other travel-related expenses. Using a travel rewards card can significantly enhance your travel experience, allowing you to enjoy perks like free flights, upgrades, and even exclusive access to events.

Why Use a Travel Rewards Credit Card?

Using a travel rewards credit card can give you several advantages. Here are a few reasons why it might be worth considering:

- Earning Potential: Many travel rewards cards offer higher points for travel-related purchases, which means you can rack up rewards faster.

- Sign-Up Bonuses: Most cards come with attractive sign-up bonuses that can provide a substantial boost to your rewards balance.

- Travel Perks: Many cards offer additional benefits like travel insurance, lost luggage reimbursement, and access to airport lounges.

Now that you understand what travel rewards credit cards are and why they are beneficial, let's dive into some of the best options available.

The Best Travel Rewards Credit Cards

1. Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card is often recommended for its generous rewards program. Here are some highlights:

- Earning Structure: Earn 2x points on travel and dining at restaurants & 1 point per dollar spent on all other purchases.

- Sign-Up Bonus: A large bonus after you spend a certain amount in the first three months.

- Redemption Options: Points can be transferred to numerous airline and hotel partners, providing flexibility in how you use your rewards.

Example: If you spent $5,000 on travel and dining in a year, you’d earn 10,000 points just from those categories—enough for a round-trip flight to many domestic destinations!

2. Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card is another great choice, especially for those who prefer straightforward rewards.

- Earning Structure: Earn 2x miles on every purchase, which makes it simple to accumulate rewards.

- Sign-Up Bonus: Generous bonus miles if you meet the spending requirement in the first few months.

- Flexibility: Redeem miles for any travel purchase, including flights, hotels, and car rentals.

Example: Let’s say you use this card for daily expenses like groceries and gas. If you spend $1,000 a month, that’s 24,000 miles in a year—enough for a free flight!

3. American Express® Gold Card

If you love dining out, the American Express® Gold Card is perfect for you.

- Earning Structure: Earn 4x points at restaurants, including takeout and delivery, and 3x points on flights booked directly with airlines.

- Sign-Up Bonus: Offers a substantial bonus for new cardholders after meeting the initial spending requirement.

- Dining Credit: Get up to $120 dining credit at select restaurants.

Example: If you dine out several times a month, those 4x points can really add up. A few dinners could quickly lead to a free weekend getaway!

How to Choose the Right Travel Rewards Card

Choosing the right travel rewards credit card can feel overwhelming, but here are some key factors to consider:

1. Your Spending Habits

Look at where you spend the most money. If you travel frequently, a card that offers bonuses for travel purchases may be ideal. If you dine out a lot, consider a card that rewards restaurant spending.

2. Travel Goals

Think about what you want from your rewards. Are you looking to earn free flights, hotel stays, or just cash back? Different cards cater to different goals, so choose one that aligns with your travel aspirations.

3. Fees and Interest Rates

Be mindful of annual fees and interest rates. Some travel rewards credit cards come with high fees, but they often provide enough perks to justify the cost. Always calculate if the rewards you earn will outweigh any fees.

4. Redemption Options

Make sure the card you choose offers flexible redemption options that suit your travel plans. Some cards allow you to transfer points to airline partners, while others let you use points for any travel purchase.

Tips for Maximizing Your Travel Rewards

To get the most out of your travel rewards credit card, consider these tips:

1. Pay Your Balance in Full

Avoid interest charges by paying your balance in full each month. This way, you can enjoy the rewards without the burden of debt.

2. Take Advantage of Sign-Up Bonuses

Make sure to meet the spending requirement for sign-up bonuses, as they can significantly boost your rewards balance.

3. Use Your Card for Everyday Purchases

The more you use your travel rewards card for everyday purchases, the more points you'll earn. Just make sure you're sticking to a budget!

4. Stay Informed About Promotions

Many credit card companies run promotions where you can earn extra points for specific purchases or categories. Keep an eye out for these opportunities.

Conclusion

Choosing the best travel rewards credit card can make a world of difference in your travel experiences. Cards like the Chase Sapphire Preferred® Card, Capital One Venture Rewards Credit Card, and American Express® Gold Card offer a variety of rewards and perks.

Consider your spending habits, travel goals, and the flexibility of redemption options when selecting a card. By using your card wisely and taking advantage of sign-up bonuses and promotions, you can maximize your rewards and enjoy unforgettable travel experiences.

Now that you are equipped with this knowledge, it’s time to find the travel rewards credit card that best suits your lifestyle and start earning those points for your next adventure!

Package includes: You will receive a total of 502 Pcs credit card stickers, sufficient in quantity to meet your daily recording and replacement needs.Sharing with your friends, family, and colleagues is also a good choice

Elegant and classic design: Credit card points and mileage stickers use blue and white as the theme colors, creating an elegant and fashionable theme sticker that adds a trendy combination to your credit card

Classified Use Helper: Credit Card Reward Stickers with patterns representing various expenses, it helps you Reward credit cards with different spending purposes. The unique design of percentages, multipliers, and blanks can help you use your credit card more efficiently and with maximum discounts

High quality choice: Rewards Theme Gas Travel Dining Categories Stickers are made of high-quality vinyl materials, with clear printing and not easily fading.Their waterproof and tear resistant properties make them very durable and can provide you with long-term service

Convenient to use: These credit card classification stickers use high-quality adhesive on the back, making it easy to stick the label and not easy to peel off. Simply clean the surface of the card and you can immediately stick and use it