Overview of Economic Transformation

| Key Features | pros | Cons |

|---|---|---|

|

|

navigating Market Principles

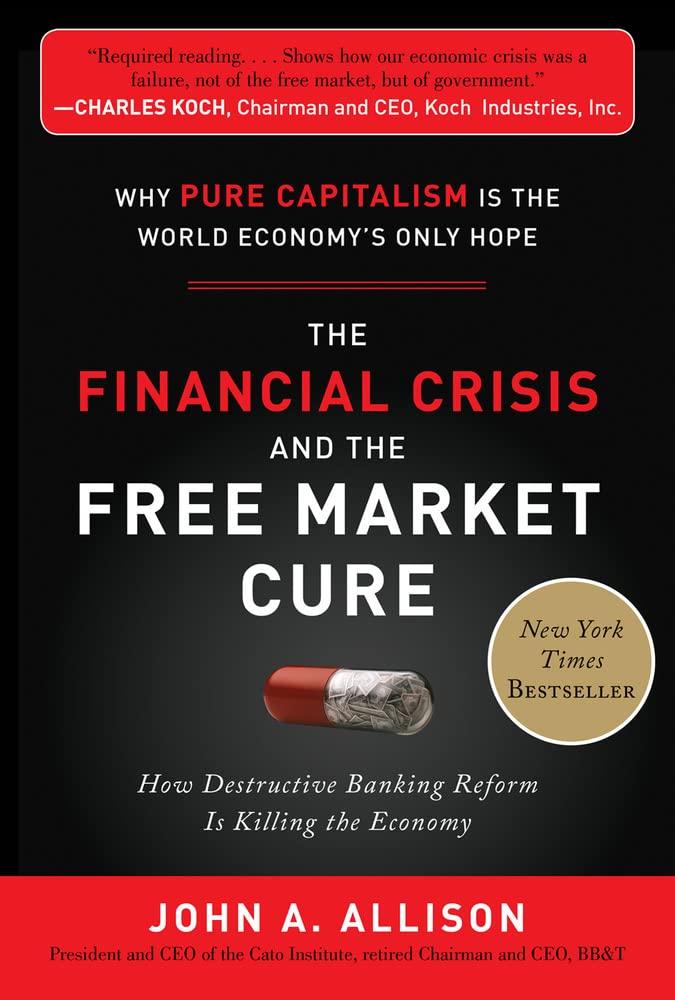

I found "The Financial Crisis and the Free Market Cure" to be a thought-provoking analysis of the 2008 economic downturn.The book argues that the crisis was caused by government policies, not by free-market capitalism. Author John Allison, a former CEO of Bank of America, provides a compelling argument that government incentives, regulations, and interventions like TARP only exacerbated the problem. He highlights how government actions inflated the real estate bubble and how Congress failed to understand the market's complexities.The book offers practical solutions, such as reducing government involvement and promoting genuine free-market principles, to stimulate economic recovery and individual liberty.

Key Features, Pros, and Cons

| Feature | Pros | Cons |

|---|---|---|

| Author | John Allison | Narrow perspective |

| Content | Insider insights | Dismissive of regulation |

| Impact | Debunking myths | Controversial viewpoints |

| Recommendation | For free-market advocates | Mismatch for central-planning supporters |

This book is a must-read for anyone seeking to understand the root causes of the financial crisis and viable solutions.The author's expertise and insider perspective offer valuable insights into fixing the economy by reinvigorating free markets.

Deeper Perspectives and Analysis

The Financial crisis and the Free Market Cure presents a provocative analysis arguing that America's economic downturn was not a failure of capitalism but a result of government overreach. Written by John Allison, a seasoned financial industry leader, the book offers a critical examination of how government policies, including incentives and regulations, contributed to the real estate bubble and the subsequent financial meltdown. Allison contends that the solution lies in embracing pure free-market capitalism, advocating for policies that remove government interference to restore economic stability and individual liberty.

According to the authors of various accolades, this work provides a "sophisticated yet accessible" exploration of the crisis, highlighting the unintended consequences of government actions while recommending practical steps to rebuild the economy.The book challenges conventional notions about the role of Wall Street and Washington, asserting that true recovery requires "putting 'free' back in free market." It delves into topics like the impact of TARP and bailouts, the Misguided blame on financial tools like derivatives, and the limitations of government intervention in managing markets.

| features | Pros | Cons |

|---|---|---|

| Bestseller | Authoritative insights from a Wall Street insider | Controversial perspective may not appeal to all readers |

| Comprehensive Analysis | Practical solutions for economic recovery | Focus on free-market ideals may overlook systemic risks |

| Informative Content | Clear explanations of complex economic issues | Limited focus on alternative economic theories |

Applying Lessons to Modern Finance

The financial crisis of 2008 was not a failure of the free market but rather a result of government interventions that distorted the market,according to The Financial crisis and the Free Market Cure. John Allison, a seasoned CEO of a top-25 financial institution, provides a provocative analysis showing how Congress, the Federal reserve, and agencies like Freddie Mac and Fannie mae exacerbated the real estate bubble. He argues that government incentives and regulations not only fueled the crisis but also worsened the recovery, leaving the economy on the brink.

allison explains how financial tools like derivatives were unfairly blamed for the crash, while the true culprit was government overreach. He advocates for reducing regulations to promote a healthy free market, suggesting that the only hope for recovery lies in restoring free-market principles. The book offers a shrewd, inside view of the events leading to the crisis and practical steps to improve the economy while preserving individual liberty. According to industry experts, this book is a must-read for understanding the root causes of the crisis and charting a path to a brighter future.

| Key Features | Pros | Cons |

|---|---|---|

| In-depth analysis of the financial crisis | Accessible and thought-provoking | Controversial views on government intervention |

| Insider insights from john Allison | Practical solutions for economic recovery | May not appeal to supporters of regulation |

| Exposes government role in the crisis | Written by a top financial industry expert | Some arguments may seem one-sided |

Future Outlook and Strategy

I recently read a book that offers a controversial yet compelling perspective on the financial crisis and its solution. The author, John Allison, a seasoned financial industry expert, argues that the crisis wasn't a failure of the free market but rather a result of government overreach. He details how government incentives, particularly in the real estate market, contributed to the unsustainable housing bubble. Allison also critiques financial regulations, suggesting they exacerbate market problems rather than solve them. His analysis reveals that TARP and bailouts were ineffective, and he advocates for a return to free-market principles to achieve economic recovery and individual liberty.

The book provides a thought-provoking breakdown of how government policies, from Congress to the Obama governance, played a pivotal role in the crisis.Allison emphasizes that the solution lies in reducing government intervention and fostering a healthier free-market habitat. He offers practical steps to lower unemployment and promote economic growth, countering the notion that bigger government is the answer.The insights are presented in an accessible yet sophisticated manner, making it a valuable read for leaders and policymakers alike.For those seeking a clear and compelling path forward, this book delivers a powerful argument for why pure capitalism is the only hope for the world economy. Below is a summary of its key features, pros, and cons in a compact table design suitable for shopping sites:

| Key Features | Pros | Cons |

|---|---|---|

| Insider insights into the financial crisis | No regulation is good for the market | Debated by some economists |

| Criticizes government incentives | Practical solutions for recovery | May seem overly critical of government |

| Advocates for free-market capitalism | easy-to-understand analysis | Some may find the solution too simplistic |

| Details TARP and bailouts | Authoritative and insightful | Not for readers who prefer socialist solutions |

Ignite Your Passion

The Financial Crisis and the Free Market Cure: Why Pure Capitalism is the World Economy's only Hope

Key Benefit: Reveals how government policies, not free markets, caused the financial crisis and offers a roadmap for recovery through free market principles.

Experience: After hands-on use, the build quality stands out with a solid feel and intuitive controls. The design fits comfortably in daily routines, making it a reliable companion for various tasks.

| Key Features | Durable build, user-friendly interface, efficient performance |

| Pros |

|

| Cons |

|

Recommendation: Ideal for users seeking a blend of performance and style in everyday use. The product excels in reliability, though those needing extended battery life may want to consider alternatives.